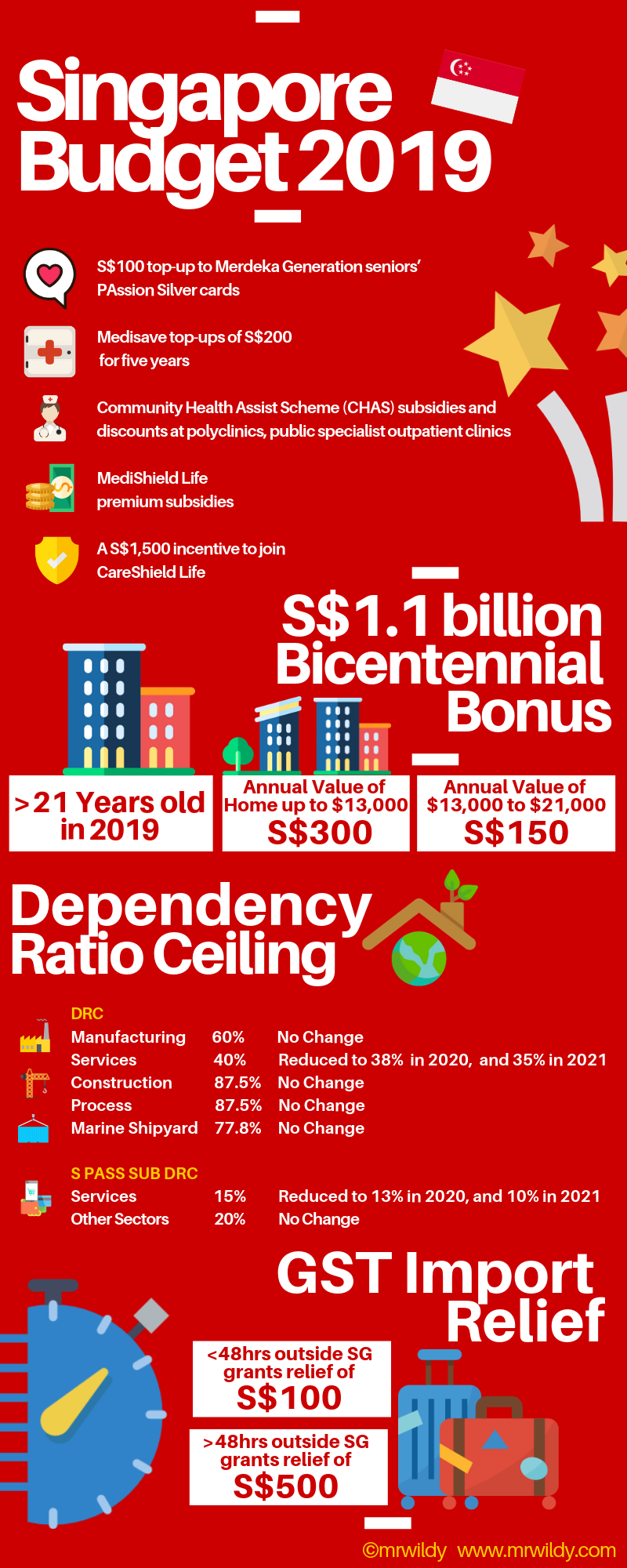

Singapore Budget 2019 Infographics - At a GlanceThe Singapore 2019 Budget was recently announced by Finance Minister Heng Swee Keat. The theme for this year's Budget was the Bicentennial Bonus, the Merderka Generation Package, as well as the Dependency Ratio. Announced on 18 February 2019, we will try to summarize the key areas of the Budget. Merdeka Generation PackageThe Merdeka Generation Package focuses on the following 5 benefits:

S$1.1 billion Bicentennial Bonus This bonus applies to Singaporeans aged 21 and above, and includes GST vouchers and a personal income tax rebate of 50% (but only capped at S$200 per Singaporean taxpayer) for income earned in 2018. In addition to this, younger Singaporeans will get top-ups to their Edusave and Post-Secondary education accounts. Older Singaporeans who are eligible will get a CPF top-off (one time only). Healthcare SupportThe CHAS subsidies will be extended to all Singaporeans for chronic conditions regardless of income. Also, existing CHAS Orange card holders will have not only chronic conditions but also common illnesses covered. The subsidies for complex chronic conditions will also be increased. Dependency Ratio CeilingAs indicated in the infographics above, there will be a lower foreign worker ratio particularly in the services sector. This will without doubt exert even more pressure on the services industry, which is already squeezed by higher rents and wages. GST Import ReliefTravellers who are away from Singapore for less than 48 hours will have to pay GST on goods purchased overseas worth more than $$100. For those away for more than 48 hours, the value of goods granted relief is increased to $S500. In addition, the duty-free alcohol entitlement will be dropped from 3L to 2L. Diesel DutyThe diesel fuel excise duty will be increased to S$0.20 per litre. In addition, the annual special tax on diesel taxis will be reduced by S$850, while the special tax on diesel cars will be reduced by $S100. ConclusionAll in all, there are pockets of benefits for everyone, especially in the healthcare segment. However, there will be more duties on goods purchased from overseas as well as on diesel. The SMEs in the services industry will also face more pressure. All these will pave the way for the impending GST increase as well.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorI am MrWildy and I am trying to journal more about my life and also my travels. Find out more about me here. Categories

All

Archives

July 2022

|

RSS Feed

RSS Feed