|

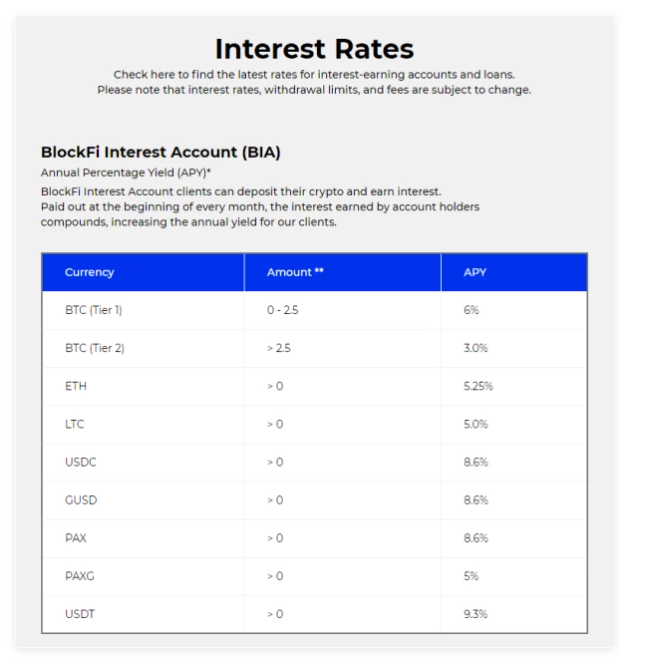

So I was reading Costanza's post on her Passive Crypto Earnings November 2020 (Lending/Dividends/Staking). Being able to generate $610 of passive income through a multitude of platforms is a brilliant idea, and it got me thinking about whether I should sign up an account with BlockFi. In any case, I have decided to do some investigation on BlockFi to ascertain their credibility, and I will also embark on my own journey to deposit some crypto assets with BlockFi just to see how it goes. If you are planning to also sign up with BlockFi, why not consider signing up via my referral link here. When you sign up and fund your account using my referral code (and deposit at least $100 or more into your BlockFi interest account (BIA), both you and I will earn $10 in BTC! What is BlockFi?BlockFi sets itself apart from other cryptoasset service providers by pairing market-leading rates with institutional-quality benefits. BlockFi's mission is to give liquidity, openness as well as performance to electronic economic markets by developing items that fulfill the needs of customers around the world. They build bridges between standard money and also digital markets that allow growth for all participants. BlockFi's very first product is a USD financing protected by cryptoassets. This offers clients the capability to access liquidity without causing a taxable event or surrendering future benefit. Horizontal development specifies their possibility to naturally broaden BlockFi's present item by using varied maturations, increasing to different nations and also including extra kinds of security beyond Bitcoin and Ether. In more simple words, BlockFi is a crypto (and wealth?) management platform focused on the following crypto assets: Bitcoin, Ethereum, Litecoin as well as some of the USD stablecoins. They do also focus on BlockFI interest accounts, Trading accounts as well as Crypto-back loans. See their product page for the full list of details. History of BlockFiBlockFi launched in August 2017 after the founders Prince and Marquez found a good way to bring their expertise in lending to the blockchain industry. They envisioned BlockFi as a foray into Bitcoin and the crypto industry, with the help of their depth and breadth of financial knowledge. They then went on to raise $1.5m from Consensys Ventures, SoFi and Kenetic Ventures. They've since raised much more fund to date (at December 2020). Investors include Mike Novogratz at Galaxy Ventures, Anthony Pompliano's Morgan Creek Digital, and Akuna Capital. What are the benefits of BlockFi? For me personally, the stability and credibility of a platform is of utmost importance, as I certainly do not want my crypto assets to be lost through a hacking incident or unnecessary mismanagement. Due to the fact that it's based in America, BlockFi needs to abide by local laws as well as guidelines safeguarding consumers. Furthermore, the group's abundant history in financing provides a tried and tested track-record customers can rely on. To date, the company has placed fantastic emphasis on remaining transparent and also customer-friendly. No surprise several of the largest names in the market back it. This broad-based support likewise means plenty of track records on the line should anything run wrong. Based on my initial research, it seems that BlockFi doesn't use the best rates in the sector. Nonetheless, the prices are competitive, and also the firm doesn't delight in high-risk habits like earning money in another indigenous token or betting tokens. So, you can rest very easy when dealing with them that you will not obtain caught up in a rip-off. They make use of Gemini as their safekeeping carrier. Why does this matter? Due to the fact that Gemini is guaranteed and also has industry-leading safety actions to ensure security at the highest degree. Is BlockFi Secure? The BlockFi website supplies 2-factor verification. All assets are not saved with BlockFi. Gemini handles all electronic properties on behalf of BlockFi. They utilize industry-leading cold storage solutions that are guaranteed. BlockFi, along with Gemini Custodianship deal extremely high criteria of protection. Nevertheless, I read an article where BlockFi experienced a backing incident in May 2020. "For just under 90 minutes last Thursday, hackers were able to compromise the systems of cryptocurrency lending platform BlockFi, and gain unauthorised access to users’ names, email addresses, dates of birth, address and activity history. In an incident report published on its website, BlockFi was keen to stress that the hacker’s activity had been logged and as such it was “able to confirm that no funds, passwords, social security numbers, tax identification numbers, passports, licenses, bank account information, nor similar non-public identification information” had been exposed. That’s obviously a relief, but there are still plenty of bad things that could be done by anyone maliciously-minded who came across the information that was successfully accessed by the hacker." Fortunately, it seemed that no funds were lost. The advice given by BlockFi is the ensure multi-factor authentication - which I do agree is the baseline of what we all should do. It might take a little more effort but its worth its weight in gold (or your favourite crypto currency, for that matter). How are BlockFi's Interest Rates? You can track BlockFi's interest rates via their website. It seems pretty decent, considering that I am currently storing my Bitcoin in a wallet without earning any interest. What is also interesting is that the interests are paid out every month, and the interest earned by the account holders are compounded, thereby increase the annual yield.

0 Comments

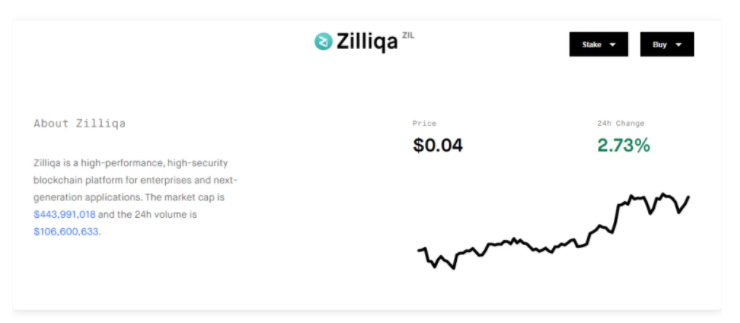

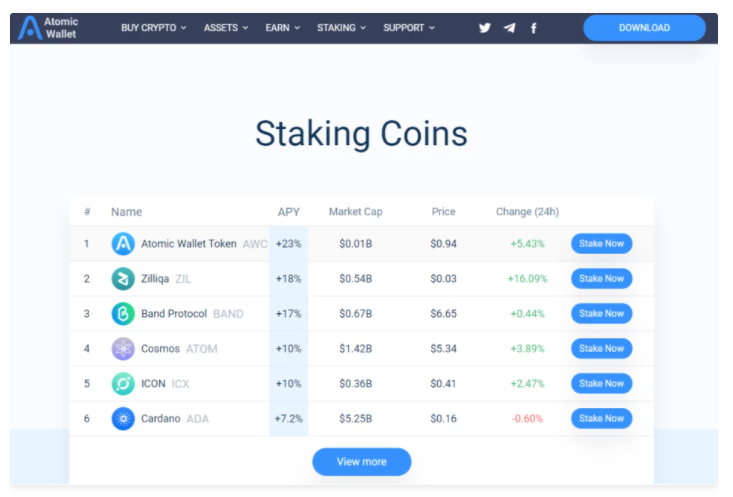

Zilliqa Rally Lately, Zilliqa (ZIL) attains yet another ground-breaking milestone. The public blockchain system has actually crossed its $0.045 cost resistance. According to news records, Zilliqa (ZIL) has actually disclosed that appearing this price level was an outcome of staking on its platform. The general public blockchain, together with the rise in its ZIL price, likewise revealed that concerning 27.457% of its total ZIL supply was presently locked in laying, including that this is the sole factor the ZIL token has recorded an exceptional rate increase. Especially, ZIL has actually been below the $0.030 rate range for a long time currently. In spite of this fantastic increase in price, ZIL token is yet to achieve a leading 50 coin setting on CoinMarketCap (CMC) again. I was fortunate to invest in ZIL before the rise, but let's face it - it's still rather tempting to invest more in ZIL, especially when we can stake it. Staking as the Reason for the Rally?The Singapore-based public blockchain system officially introduced staking on its system in June 2020. Considering that its laying launch in June, the system has actually had various other amazing updates. For one, Zilliqa currently uses stakers APY as high as 17.72%. Additionally, a tremendous 27.457% of its total ZIL distributing supply is presently secured laying. The blockchain platform also takes pride in 20,320 delegates as well as a total of 11 staked seed nodes. Zilliqa's (ZIL) non-custodial staking system is called Zillion. Interestingly, Zillion is just one of the first-ever staking systems improved a sharded blockchain. This vital function truncates the need for a third-party throughout staking on the platform. Interested individuals can conveniently deposit their symbols right into clever agreements, providing the general public blockchain with an easier to use, seamless platform. How to stake ZilliqaZilliqa blockchain consensus is achieved via sensible Oriental Fault Resistance (pBFT). Financiers can leverage their crypto through laying. Betting continues to rise in prestige. In other words, everybody is doing it. Proof-of-Stake has rapidly end up being the preferred agreement system among new networks. But the crazy isn't constrained to layer-1 platforms. Multiple DeFi tasks adopted staking versions as part of their tokenomics change. As even more tasks join the betting revolution, the marketplace capitalization of staking networks and also the overall value secured staking need to advance its higher trajectory. Initially presented as a Zilliqa Enhancement Proposal (ZIP) previously this year, staking on Zilliqa will certainly allow for better decentralisation throughout its seed node architecture. Concurrently, the solution will certainly incentivise the involvement of pick node operators as well as area participants to sustain the service. The recently launched Zilswap, a decentralised exchange built by Switcheo Exchange on the Zilliqa network, will also allow customers to easily hold their gZIL, take out, trade, and re-stake their staking rewards, or pool ZIL and also gZIL benefits in betting pools on Zilswap. Based on the official internet site, You have an incentive to stake and #HODL over the long term as the community gains in worth. Benefits are supplied to $ZIL HODLers for entrusting their tokens and risk. As even more individuals risk & reinvest in our environment as well as even more projects sign up with, our Open Financing (OpFi) facilities will be powered up using $ZIL as the cash and also liquidity incentive. As a result, by rise usage of the platform an enhancing amount of transaction charges (in $ZIL) will certainly be "burned", allowing for a sustainable circular economic climate. Conclusion I have some ZIL staked as well. As I am residing in Singapore, I purchased my ZIL via Coinhako. Coinhako is known for being the easiest platform to buy Bitcoin and Digital Assets in Singapore, and Asia. I then made a transfer to two staking sites, namely Atomic Wallet and ZilPay. Atomic Wallet is great as it allows me to determine my returns based on a 14-day to 365-day time horizon, and its online calculator is easy to use. Let me continue to research it a bit!

|

AuthorI am MrWildy and I am trying to journal more about my life and also my travels. Find out more about me here. Categories

All

Archives

July 2022

|

RSS Feed

RSS Feed