|

There is money to be made in Cryptocurrency trading, but you need to avoid these 10 mistakes if you want to be profitable. Crypto gains have attracted a whole new segment of investors, bringing in more capital and growing the market to over $0.5 trillion this year. However, not everyone is making money, and unfortunately, most new crypto traders are making mistakes that can easily be avoided. If you are investing in coins for the long-term, the safest strategy is holding, but day-trading, or even casual trading can be profitable in the short term, allowing you to increase your stack relatively faster. Whether you’re a beginner to crypto trading or just trying to take a chance in this exciting new market, here are 10 mistakes you should avoid.  1. Falling for shills; not doing your own research Almost everyone joins Telegram groups and follows Twitter traders for signals, and there is nothing wrong with that, as long as you do your own research. There is no shortage of ‘shilling’ (promoting coins and market moves for personal gain) across all social mediums, and you will come across tons of people claiming that a particular coin is going to ‘moon’ soon or give 10x gains. If you just listen to these people and put your money on the line, you are extremely likely to lose it. Most of these shills are either fake accounts, paid promoters or members of pump and dump groups, who are creating fake hype to promote FOMO (fear of missing out) and getting more people to buy what they are selling. Doing your own research is the most important step before you enter any market. You need to understand what a coin does, how the price moves, what stage is the development at and so on. Running blindly into trades just because you see a pump is a recipe for disaster. 2. Not understanding basic charting fundamentals Most traders think charting or technical analysis is either extremely complicated, or just over-rated. While both views can be argued, there is no denying the fact that market movements and coin prices have patterns that can be identified and used for, at the very least, ‘increasing’ the chances of successful trades. Just like everything else in life, there are no guarantees in the crypto market, and given how it is largely speculative and emotion-driven, charting and technical analysis will, and does fall apart now and then. That being said, if you are serious about trading, you should understand the basics, such as candlesticks, support and resistance zones and trendlines. Details of technical analysis will not be discussed in this piece, but we will be publishing more in-depth guides and tutorials in the future. For starters, you should understand that resistance zones are price ranges which a coin has repeated failed to break through, while support zones are where the price often bounces back. Identifying these zones can help you assess where the current price stands, and whether it has room to go higher or drop further. Trend lines are also quite simple, where an uptrend is indicated by the price making ‘higher lows’ (green line in the screenshot below) and a downtrend is reflected by ‘lower lows’. The screenshot above is a basic representation of these concepts, where the horizontal lines roughly mark zones where price either finds a ceiling or a floor, and generally, in an uptrend, past resistance zones can become supports later on (notice how candles earlier failed to breach the second-last horizontal line, but later bounce off from the same) and in downtrends, support zones can become resistance. 3.Panic selling at the bottom, buying back at the top The crypto market is extremely volatile, which means price swings are normal, and if you get spooked easily, you will lose money. Panic selling is a common mistake beginners make, where they first get into a market without much research and then, when faced with a sudden drop, sell to ‘cut their losses’. The problem with this approach is that once you sell, you’ve actually lost money (you don’t lose until you sell), and while in some cases, cutting your losses does make sense, most coins will bounce back in days, if not hours, and then the same people, seeing a surge, buy back at higher prices, only to repeat the cycle. Buying high and selling low is a one-way ticket to going broke. 4. Not taking profits; no exit plans You found a good entry, and the price has gone up, what now? Do you book your profits and exit? Do you keep holding? If so, why? Most beginners don’t have any exit plans and just wing it as they go along, and in most cases, end up either losing their profits, or actually going into loss and have to hold the coins until they can break-even. As I said earlier, if you are buying to hold long-term, you are not trading, but if you are trading, you should have an exit plan, where you book your profits and move on. Granted, at times you may see the price going higher after you take profits, but as a trader, you need to expect that. One very effective strategy however, is to sell in stages instead of selling all your coins in one go. This way, you give up a percentage of immediate profits to have a chance at riding the surge higher. 5. Looking for the next Bitcoin, Ethereum or Litecoin This year alone, Bitcoin has gone from $1,000 to $20,000, which is an obviously impressive gain. Ethereum and Litecoin have also recorded similarly massive returns, but not every coin can, or will, follow the same path. Some coins, either due to their large supply, or a host of other factors, are relegated to certain price ranges (for example Ripple), and investing in coins, hoping for 2,000% or 4,000% gains is not a sound plan. As a trader, you need to understand the specifics of each coin that you trade, and that includes its price history and reasonable future projections, so you can plan your trades accordingly. 6. Getting emotionally attached to a coin No coin will go up forever, even Bitcoin has very good days, and then some really rough ones. The crypto space is ever-changing and evolving, with new opportunities coming up every day. If you believe in a coin, holding it for long-term returns is a good approach, but if you are looking to make money by trading, you cannot have emotional attachments with any coin. When Bitcoin is dropping from $20,000 to $12,000, it is hardly smart to keep holding on to it. Similarly, if a coin is surging ahead of an important announcement, you can easily double or even triple your investment with it, instead of holding Bitcoin at $20,000, expecting a $500 gain. 7. Spending all your money in one go Another very common mistake beginners make is spending all their trading money in one go. If you find a good entry, you should buy in with a percentage of your funds (50% - 60%) and hold the rest to see whether your entry works. This way, even if a coin drops following your purchase, you can average it down by buying more at the dip. Similarly, if the uptrend continues, you can always buy more, and even though this approach reduces your profit margins, it secures your position and prevents you from being all-in on a trade that goes south. 8. Putting all your eggs in one basket Even the most hyped of coins can, and do suffer from major dips while the market as a whole stays green. Cryptocurrencies are unpredictable and in a state of evolution, which means there is no single coin (not even Bitcoin) that is ‘guaranteed’ to survive down the road. Whether you are holding, or trading, you cannot afford to put all your funds in one coin. Diversification and risk management is the key to a sound portfolio and finding good entries in multiple coins will increase your chances of profiting. 9 Thinking cheap is always better Just because a coin is cheap does not mean it is a better buy or has a higher chance of profits. While it is true that it’s easier for a $0.05 coin to reach $0.10 compared to a $500 coin reaching $1,000, but it is also easier for a $0.05 coin to go down to $0.01, wiping you out completely. The key here is to not just take price as an indication of profitability, and conduct your research to understand why a particular coin is cheap, and which, if any, upcoming developments can boost the price. 10. Not following the news Price movements, charting and market analysis is not enough. If you want to be a successful trader, you need to follow crypto news and stay up to date on all recent and upcoming developments. Since crypto is a speculative market, it responds very strongly to both positive and negative news, and being in-the-know is invaluable for a trader. On Cryptovest.com, we cover everything of note in the crypto space and make sure our readers get the latest updates as they happen. If you want to get updates instantly, you should subscribe to our mailing list or activate push notifications. Source: Cryptovest

0 Comments

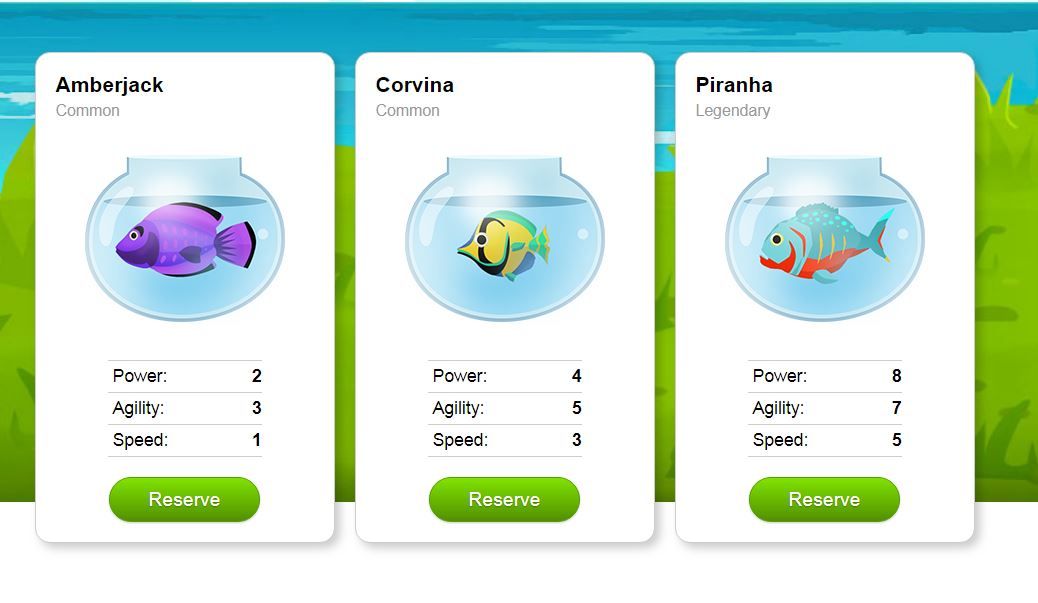

Guys and girls, there's a new player on the Ethereum network. Move over kitties, now it' time for the predatory fish to take over. Fishbank - a game where players battle it out amongst themselves. I just hope no kitties will be caught in the ensuing bloodbath. Every fish is a digital crypto asset and apparently - there is a hardfork effect too - a single rare fish token for every owner of Gen 0 CryptoKittie as of 1st January 2018. In this case, Every fish is an ERC-721 crypto token stored on the Ethereum blockchain. Digital asset 100% owned by the player. It can be managed like a regular cryptocurrency — transferred or sold to any other player. It cannot be destroyed, removed or replaced. Join in the fun early -- who knows! Your fishes might bring you some valuable ETH? Find out more here. |

AuthorI am MrWildy and I am trying to journal more about my life and also my travels. Find out more about me here. Categories

All

Archives

July 2022

|

RSS Feed

RSS Feed